Back to Main Page

Analysis of the "Flash Crash"

Date of Event: 20100506

Part 2-b, Previous Occurrences - NYSE Quotes

| If the quotes sent from the NYSE were stuck in a queue for transmission

only to be time stamped when exiting the queue, then all data inconsistencies

disappear and things make sense. In fact, this very situation occurred on 2

separate occasions at October 30, 2009, and again on January 28, 2010

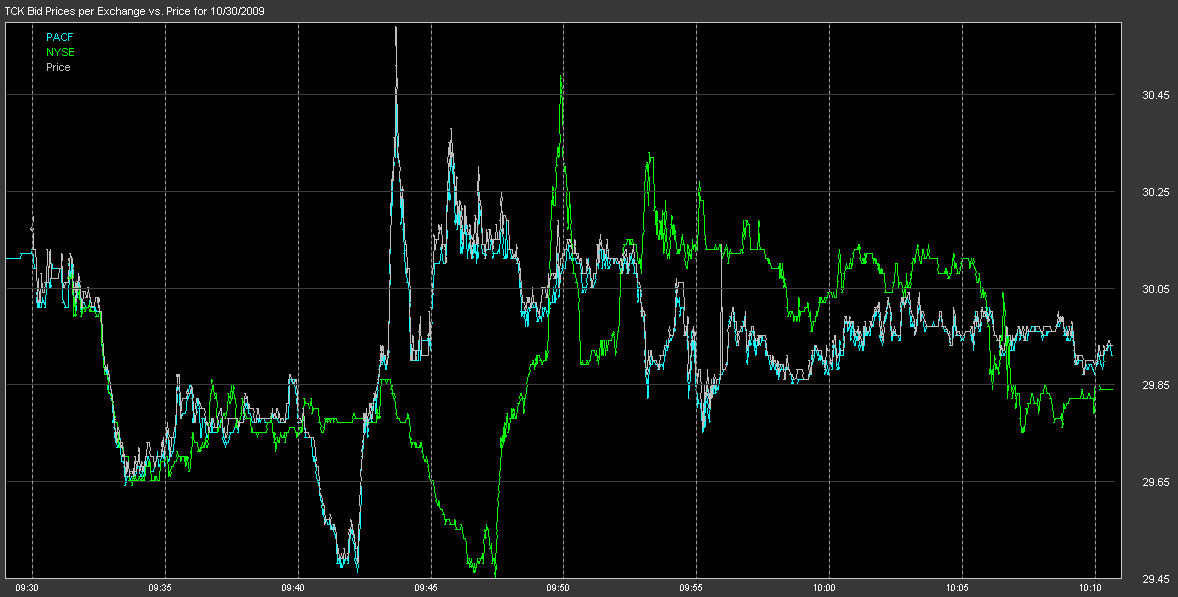

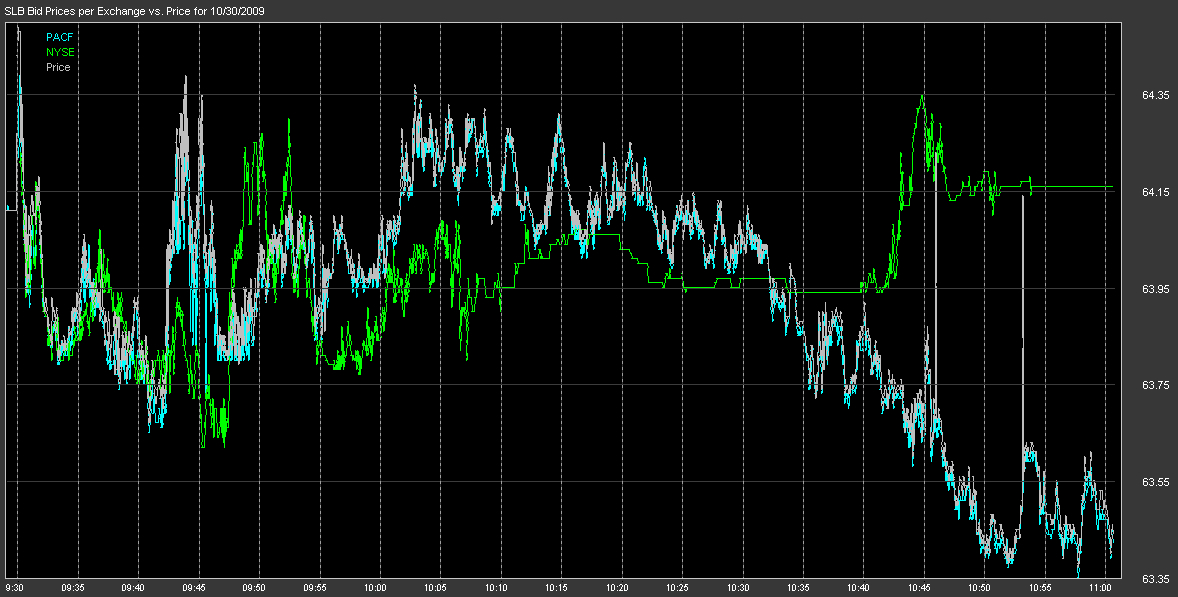

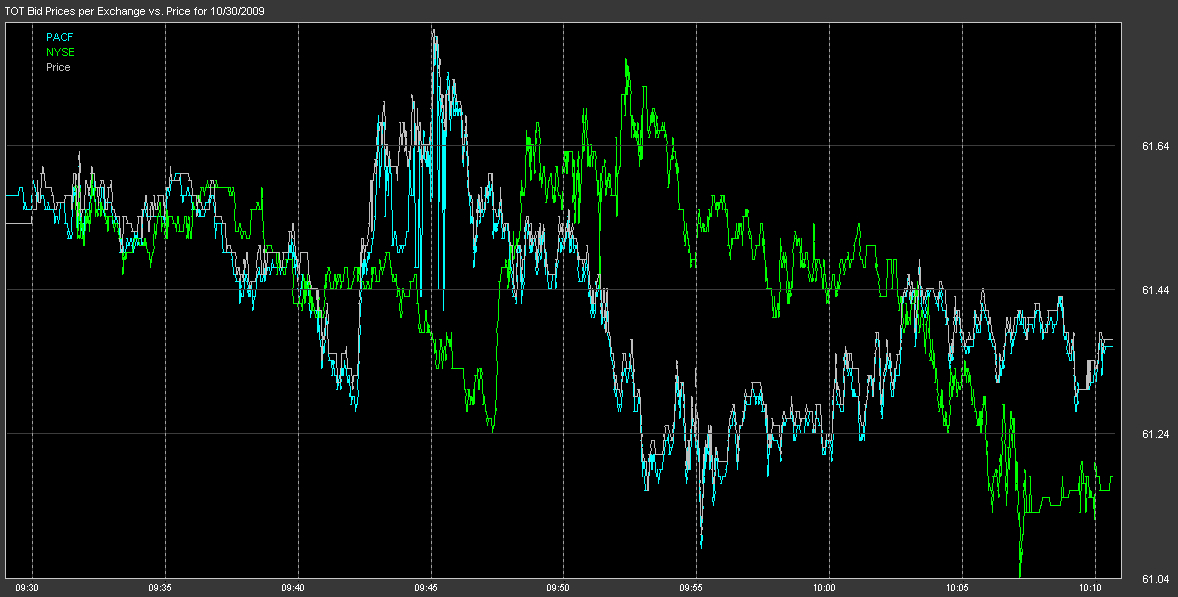

as shown below. Charting the bid/ask cross counts for those two days reveals the same pattern as 5/6! Looking at the details of the trade and quote data on those days shows the same time stamp/price inconsistencies. The NYSE stated that during the same intervals, they were experiencing delays in disseminating their quotes! In summary, quotes from NYSE began to queue, but because they were time stamped after exiting the queue, the delay was undetectable to systems processing those quotes. On 05/06/2010 the delay was enough to cause the NYSE bid to be just slightly higher than the lowest offer price from competing exchanges, but small enough that it was difficult to detect. This caused sell order flow to route to NYSE -- thus removing any buying power that existed on other exchanges. When these sell orders arrived at NYSE, the actual bid price was lower because new lower quotes were still waiting to exit a queue for dissemination. The following charts show individual stocks were the NYSE quotes were lagging noticably behind the market on 10/30/2009. This was a day were NYSE did make announcements that their quotes were running behind (see above). |